Revolutionizing Data Interoperability in Financial Services

Metro Credit Union partnered with Docusign to address inefficiencies in their backend loan processing, caused by disconnected systems and manual data entry. By implementing the Docusign IAM platform, they achieved a 75% increase in back-end efficiency and near-instant processing times.

- The hidden cost of disconnected systems

- The turning point: Why Metro needed a smarter way to work

- The strategy: Use the Docusign IAM platform to connect systems, streamline workflows, and scale efficiency

- The results: Faster, smarter, and ready to scale

- Extending the experience: Metro’s vision for smarter onboarding

- The takeaway: Interoperability isn’t optional anymore

Table of contents

- The hidden cost of disconnected systems

- The turning point: Why Metro needed a smarter way to work

- The strategy: Use the Docusign IAM platform to connect systems, streamline workflows, and scale efficiency

- The results: Faster, smarter, and ready to scale

- Extending the experience: Metro’s vision for smarter onboarding

- The takeaway: Interoperability isn’t optional anymore

Loans enable bank and credit union customers to fulfill dreams of a new car, a new boat, a home renovation, and so much more. However, when a financial institution’s back-office systems operate in silos rather than in sync, essential loan agreement information can easily be delayed, duplicated, or even lost somewhere between the initial application and final approval.

That fragmentation creates inefficiency across teams and introduces risks.

As the stewards of life’s most important money matters, financial institutions need data interoperability: A connected architecture that eliminates breakdowns between systems, improving speed and reducing errors for teams and customers.

That’s the challenge Metro Credit Union set out to solve with Docusign.

The hidden cost of disconnected systems

Finserv organizations want to do it all: Grow their business, boost efficiency, and deliver smooth customer experiences—all while keeping pace with digital transformation, cloud adoption, and AI. But banks and credit unions trying to do it all can experience lags in customer approvals or document processing, which can weaken trust and drive attrition. And in a crowded and competitive marketplace, that’s bad for business.

But with the right tools in place, the loan experience can be effortless for both the institutions and their customers.

And yet, many financial institutions today operate on fragmented tech stacks. Tools for loan origination, processing, and servicing are often disconnected. Agreement data ends up locked in static PDFs or siloed systems—a problem we call the “Agreement Trap.”

Manual processes make it worse. Back-office teams spend hours re-entering data, which slows down high-volume workflows like onboarding or automatic payment setup. These gaps also introduce risk for both reputation and compliance, particularly in meeting strict federal and state-level regulations.

The turning point: Why Metro needed a smarter way to work

Metro Credit Union is the largest state-chartered credit union in Massachusetts, serving 200,000 members across 18 branches. For Metro, a member-owned credit union, delivering warm, personal service isn’t just a goal—it’s part of the brand.

A Docusign customer since 2019, Metro modernized its customer-facing loan payment experience using Docusign PowerForms. That digital upgrade was a huge benefit for members, but the back office was having trouble keeping pace. The elimination of manual paper-based processes had increased auto-loan payment setup applications to 600+ per month, and staff were spending 50+ hours/month manually transferring data into COCC/Fiserv, their core banking system.

As a regional institution without in-house developers, Metro needed a no-code way to bridge front-end data capture with back-end systems. Their goals were clear:

Eliminate manual rekeying and reduce processing time

Maintain their trusted, high-touch member experience

Automate compliance by reducing manual errors, capturing data accurately, and integrating securely with COCC, Metro’s Fiserv DNA-powered banking system

Scale to handle growing application volume

In addition to loan processing, Metro also wanted to streamline other high-volume processes like new member applications and clerical changes (e.g., address updates), which still required time-consuming manual verification.

The strategy: Use the Docusign IAM platform to connect systems, streamline workflows, and scale efficiency

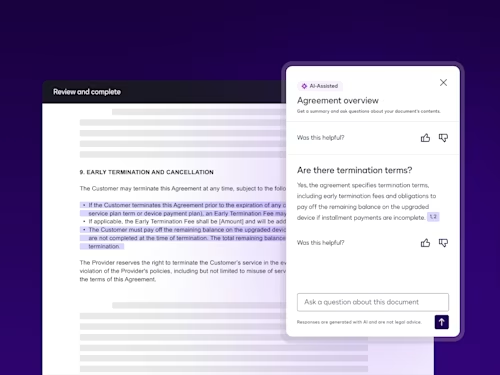

Building on the success of Docusign capabilities for their member-facing digital workflows, Metro turned to Intelligent Agreement Management (IAM), making the Docusign IAM platform the cornerstone of its back-office digital transformation strategy. Their goal was to unlock agreement data trapped in PDFs and automate manual processes—eliminating bottlenecks by embracing streamlined workflows.

Metro’s IAM platform implementation focused on:

Seamless integration with core systems like COCC/Fiserv

Automation at scale using no-code tools

Built-in compliance support through end-to-end audit trails

Straight-through processing across workflows

Flexible, modular architecture that didn’t require a system overhaul

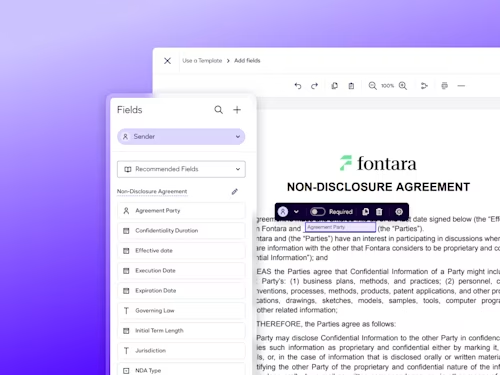

To bring this strategy to life, Metro deployed a suite of IAM platform tools and integrations:

Docusign Web Forms: Captures data and dynamically populates content into agreements for signature in one easy-to-use, interactive customer experience

Docusign Maestro: Orchestrates the entire automated workflow, from data capture to back-end integration—eliminating the need for staff to reconcile updates manually

Third-party integrations:

COCC: Form data flows seamlessly to Metro’s core banking platform

Sandbox Banking's Glyue App: A low-code integration platform that seamlessly connects IAM platform workflows with core banking systems like COCC and Fiserv DNA, enabling real-time data synchronization and straight-through processing without the need for internal developer resources

During the transformation, Metro’s front-end interfaces remained unchanged. Members continued to enjoy the same intuitive, digital-first experience they were used to. Behind the scenes, the IAM platform embedded compliance support, identity verification, and security throughout the workflows, further reinforcing Metro’s reputation as a trusted financial partner. And, thanks to the IAM platform’s modular, building-block architecture, the credit union was able to scale and extend workflows without having to replace or overhaul its existing systems.

The results: Faster, smarter, and ready to scale

Without adding staff or disrupting service, the Docusign IAM platform enabled Metro to scale loan processing operations efficiently and achieve remarkable results:

75% increase in back-end efficiency within the first four weeks of going live

Projected to reach 90% as additional enhancements roll out

Near-instant processing times for tasks that once took hours

Reduced manual error and audit risk

Greatly improved data accuracy and significantly reduced NIGO rates

“With the Docusign IAM platform, Metro Credit Union streamlined auto-loan processing from tens of hours to seconds.”

Traci MichelCOO and CSO, Metro Credit Union

Extending the experience: Metro’s vision for smarter onboarding

On the heels of this initial success, Metro plans to extend IAM deeper into the member journey. That means enabling seamless onboarding right at the dealership, where loan decisions and customer expectations move fast.

The flexibility of the IAM platform’s low-code architecture enables Metro to scale and adapt workflows without overhauling infrastructure, making it easier to support new use cases across the organization. By streamlining onboarding at the dealership, for example, the credit union will eliminate operational friction in partner workflows and provide a secure, seamless process from the very first touchpoint.

The takeaway: Interoperability isn’t optional anymore

In financial services, trust and efficiency are everything. But without data interoperability, back-office operations become bottlenecks—and compliance risk multiplies. Metro Credit Union’s journey with Docusign shows what’s possible: Smarter workflows, faster processing, and secure, scalable systems that accelerate the member experience from start to finish.

Visit Docusign for financial services to learn how the Docusign IAM platform can improve the flow of agreement data and move your financial institution forward.

Docusign IAM is the agreement platform your business needs