Empower Financial Customers with Self-Service Account Maintenance Agreements

Transform account servicing requests with the Docusign IAM platform. Provide clients with smooth online experiences by eliminating paper or PDF forms and empowering agents to prioritize high-value customer experiences. Automate data flow and compliance with seamless data interoperability across all your legacy systems.

Banks and credit unions face a difficult balancing act. Their customers want to handle basic account activities, such as name or address changes and beneficiary updates, via self-service. But, they also frequently have questions that require the expertise of a human agent, and institutions may have KYC/AML requirements that can only be handled in person at a branch.

Unfortunately, this situation is worsened by the outdated technology used to process customer requests. These systems are often complex, disconnected, and require multi-step verification processes—creating bottlenecks and delays for customers.

In a recent survey conducted by Deloitte and Docusign, 66% of today’s agreement professionals cited inefficient agreement workflows as a driver for negative customer satisfaction. Speed, simplicity, and personalization are now table stakes for customer expectations.

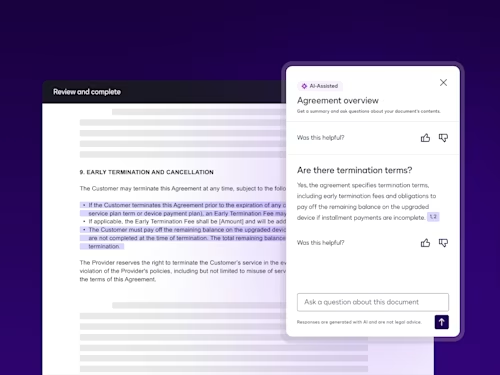

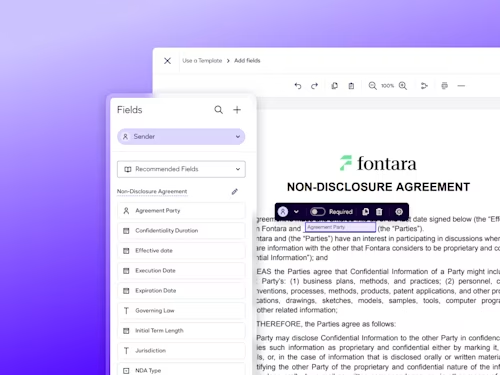

To deliver the experiences customers now expect, financial institutions need to balance self-service with compliance adherence and legacy systems. Intelligent Agreement Management (IAM) is designed to connect and automate every step of your agreement processes.

Docusign IAM for CX securely connects data across all systems in client agreement processes, balancing customer experience with compliance requirements. With seamless integrations with partners like Sandbox Banking, Microsoft Dynamics 365, IAM for CX enables real-time, bidirectional data syncing across systems and complex workflows.

A sample workflow could start with an agent capturing the initial customer request—such as an address change—and beginning to fill out a Web Form. Based on the information the agent enters, the Docusign Maestro workflow builder tool will use predefined conditional logic to determine next steps and automatically pre-fill data fields in the template to minimize errors. If necessary, the customer receives a prompt to upload documents or verify their identity using a government-issued ID or an AI-powered biometric check, and then enter any remaining information into the form and consent to the changes. That data then flows to the relevant banking systems or CRM and is updated automatically.

“The integration of Docusign has been transformational for our processes and our ability to provide best-in-class digital solutions to our sales representatives and our clients.”

Misty SuttonSVP Project Management and Automation, Primerica

The Docusign IAM platform empowers your organization to simplify account maintenance processing. With seamless integrations to your existing systems and built-in compliance support, you can consistently provide smooth and efficient customer experiences. Ready to learn more? Get in touch with us today.

Docusign IAM is the agreement platform your business needs