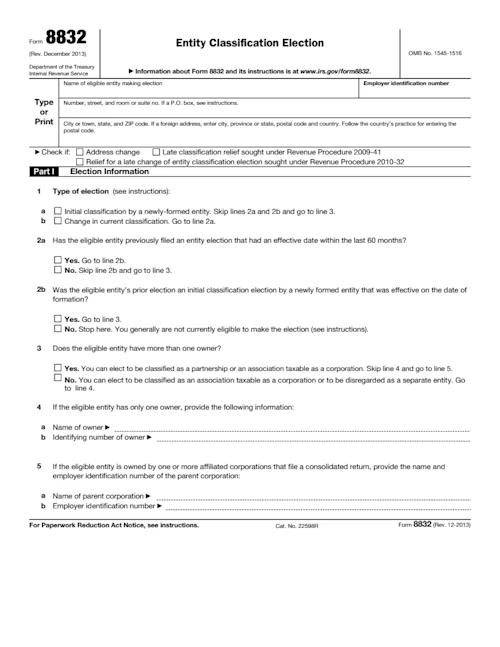

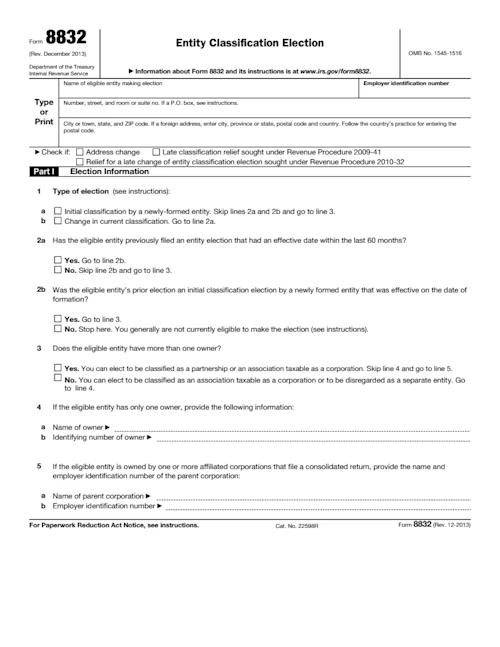

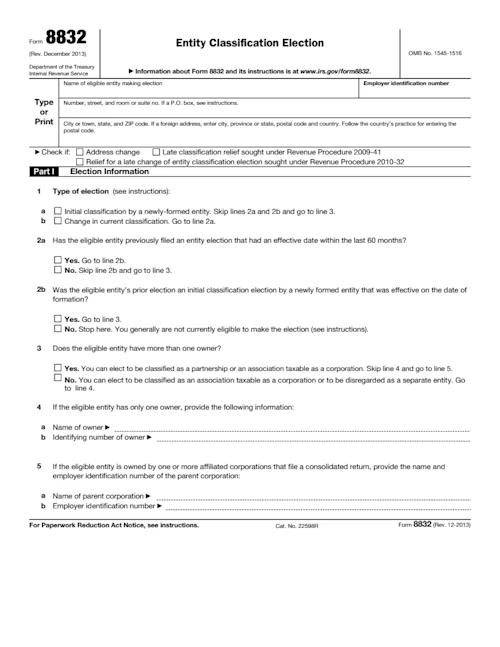

8832 form

8832 form

Choose your LLC's tax status with the Entity Classification Election. Our fillable 8832 form changes your default IRS tax classification.

The 941 form is an official tax form used by employers to report income taxes, Social Security, and Medicare taxes withheld from employees’ wages to the IRS. Formally referred to as the Employer's Quarterly Federal Tax Return, It must be filed quarterly to ensure that the correct amount of payroll taxes are being paid by the business.

Our standard 941 form is the same you would receive on the IRS website, but with Docusign, you can fill out the form online, edit the necessary details and keep it in your account for safe keeping. With Docusign, we make tax season a little less stressful. All you need to do is sign in or register for a free Docusign account by clicking on the 941 template below:

One way to ensure you meet deadlines and comply with IRS regulations is to simplify the tax filing process and Docusign can help you there. Our editable Form 941 template, combined with Docusign for digital submission, provides an organized and streamlined solution; allowing for easy completion, secure sending, and reliable record-keeping. Get started with today to ensure your quarterly tax filings are always on track.

Form 941, also known as the Employer’s Quarterly Federal Tax Return, is an IRS form that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employees’ paychecks. It also reports the employer’s portion of Social Security and Medicare taxes. This form is critical for ensuring the IRS receives accurate payroll tax information on a quarterly basis.

Form 941 must be filed every quarter by most employers, and it helps the IRS track payroll tax liabilities and payments. It includes details like the total wages paid, taxable Social Security and Medicare wages, and the taxes withheld and owed.

In short, Form 941 tells the IRS:

How much you paid your employees during the quarter

How much federal tax you withheld from their paychecks

How much you owe in employer payroll taxes

Most employers who pay wages subject to federal income tax withholding, Social Security, and Medicare taxes must file Form 941 quarterly. This includes corporations, partnerships, and sole proprietors with employees.

You generally need to file Form 941 if:

You have employees and withhold federal income, Social Security, or Medicare taxes from their wages

You owe the employer’s share of Social Security and Medicare taxes

You paid wages during the quarter, even if you didn’t owe any taxes

Certain employers, such as some household employers or seasonal employers, may have different filing requirements or use other forms. For detailed guidance, consult the IRS Form 941 instructions or the IRS Employer’s Tax Guide.

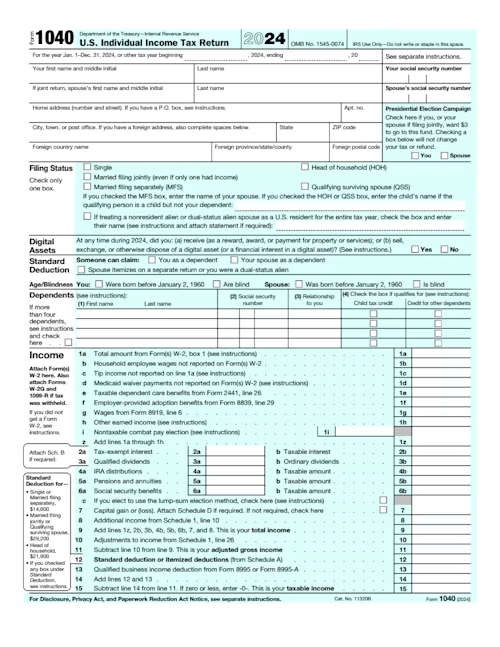

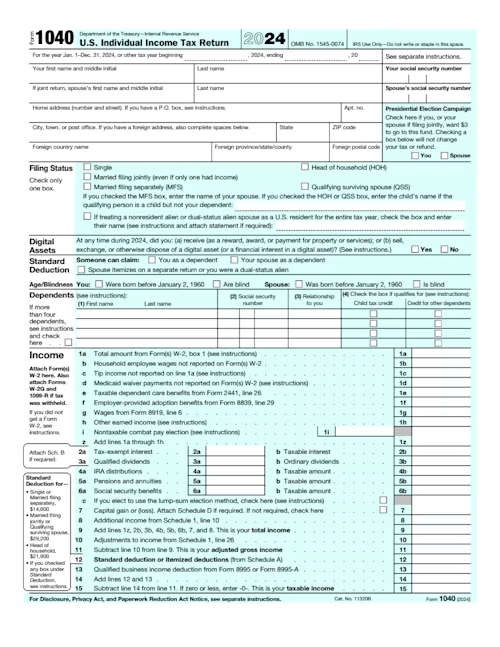

Form 941 is a multi-page form that includes sections for:

Employer identification information (name, EIN, address)

Number of employees and total wages paid

Taxable Social Security and Medicare wages

Taxes withheld and owed

Adjustments for sick pay or tips

Deposits made and balance due or overpayment

The IRS updates the form regularly to reflect changes in tax law or reporting requirements. The latest version is always available on the IRS website.

Filling out Form 941 requires accurate payroll records for the quarter. You will need to:

Report total wages and tips paid to employees

Calculate taxable Social Security and Medicare wages

Report federal income tax withheld from employees

Calculate employer and employee shares of Social Security and Medicare taxes

Account for any tax credits or adjustments (like sick leave credits)

Report deposits already made and any balance due

The IRS provides detailed instructions for Form 941, and many employers use payroll software or consult tax professionals to ensure accuracy.

Employers can file Form 941 electronically using IRS-authorized e-file providers. Electronic filing allows for secure submission, faster processing, and reduces errors.

The IRS accepts electronic signatures when Form 941 is filed through:

Approved e-file software providers

Payroll service providers offering e-filing options

These systems verify that:

The submitted data matches the required fields of the paper form

The electronic signature is valid and linked to the authorized filer

Required declarations and certifications are included

A signed copy can be produced if requested by the IRS

While Docusign can be used to collect and manage signed payroll tax authorization forms (such as Form 8655, which authorizes third-party filing), actual submission of Form 941 must be done through IRS-approved electronic channels.

Filing Form 941 electronically offers several advantages:

Faster processing: Quicker IRS acknowledgment and error checking

Reduced errors: Automated checks minimize mistakes compared to paper forms

Convenience: Employers can file directly from payroll software or service providers

Secure transmission: Data encryption protects sensitive payroll information

For businesses looking to streamline payroll tax reporting, electronic filing combined with electronic signature tools helps simplify compliance and saves time.

Disclaimer: These templates are provided for informational purposes only and do not constitute legal advice. They should not be construed as regulatory, legal, or privacy law compliant. The templates are not a substitute for professional legal counsel and should not be relied upon for any specific situation or circumstance. Users are strongly advised to consult with a qualified attorney licensed in their jurisdiction before using or adapting these templates.

The templates are provided on an "as is," "with all faults," and "as available" basis. The provider expressly disclaims all warranties of any kind, whether express, implied, statutory, or otherwise, including but not limited to any warranties of merchantability, fitness for a particular purpose, or non-infringement.

Docusign does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials in these templates or otherwise relating to such materials or on any sites linked to these templates.

Choose your LLC's tax status with the Entity Classification Election. Our fillable 8832 form changes your default IRS tax classification.

Tax season is here! Easily populate 1099s for your independent contractors. Don't wait until the deadline. Use our 1099 template.

Before you pay a contractor, get a W-9. Our customizable W-9 form makes it easy to collect all the necessary information the IRS is looking for.

Choose your LLC's tax status with the Entity Classification Election. Our fillable 8832 form changes your default IRS tax classification.

Tax season is here! Easily populate 1099s for your independent contractors. Don't wait until the deadline. Use our 1099 template.

Before you pay a contractor, get a W-9. Our customizable W-9 form makes it easy to collect all the necessary information the IRS is looking for.