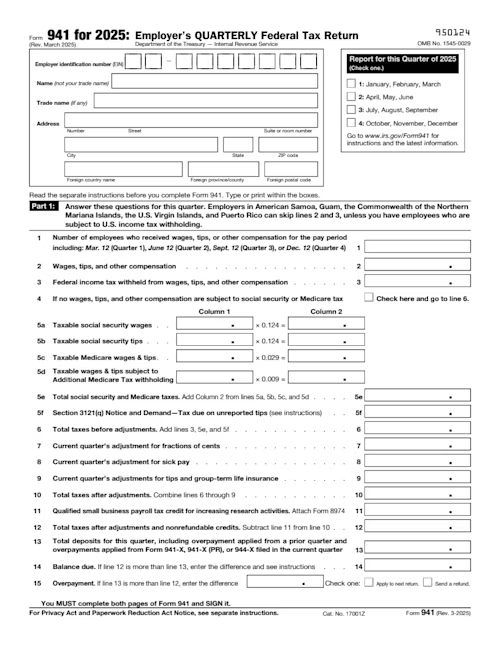

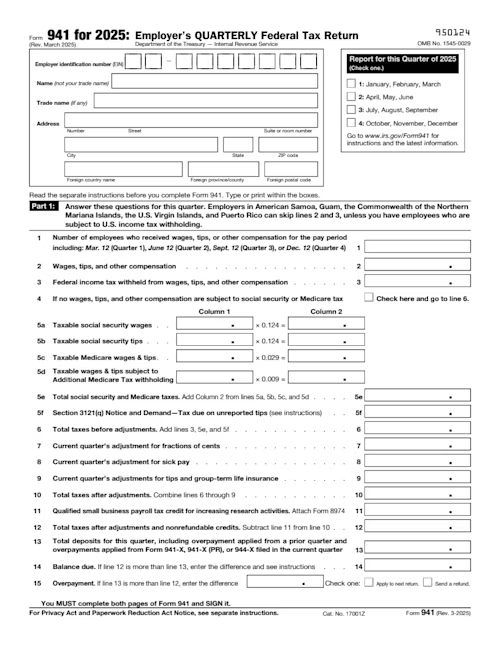

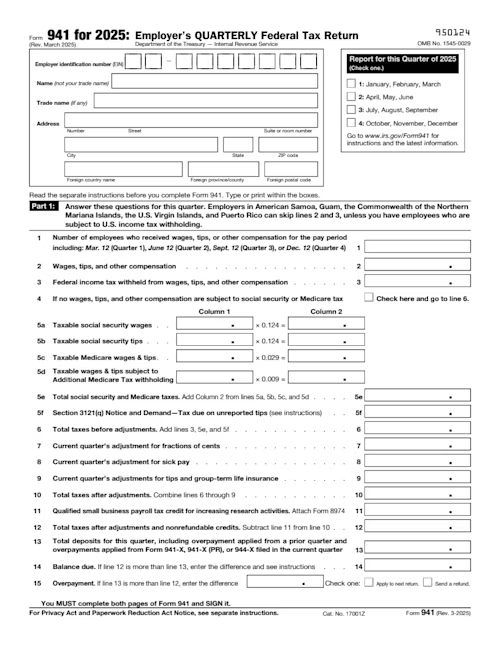

941 form

941 form

Stay on top of payroll taxes. File your employer's quarterly federal tax returns with our fillable 941 form.

The IRS Form 8832 is how your LLC tells the government how it wants to be taxed. Think of it as choosing your company's financial identity. Officially, the Entity Classification Election form lets you select how to be treated in the eyes of the IRS; a sole proprietor, a partnership, or a corporation for tax purposes. Getting this classification right from the start is essential for proper tax reporting and staying on the right side of the IRS.

And Docusign is here to help you make that choice. Our free Form 8832 template provides all the standard fields required by the IRS, so you can fill out your LLC’s information online with ease. The editable tax form is simple to complete and can be downloaded, printed, or sent through Docusign for secure record-keeping before you submit it. Click on the 8832 example below to get started:

Properly classifying your LLC for tax purposes with Form 8832 is a foundational step for your business. Using a template with Docusign streamlines the preparation process and provides a secure digital copy for your records. Together you’re on your way to a proper LLC in the eyes of the government. Ready to set your company’s tax status? Get started with a free Docusign account.

Form 8832, also known as the Entity Classification Election, is an IRS form that allows a business entity to choose how it will be classified for federal tax purposes. This form is commonly used by LLCs and other eligible entities to elect to be taxed as a corporation, partnership, or disregarded entity. Filing Form 8832 ensures the IRS recognizes your preferred tax treatment, which affects income reporting, deductions, and filing obligations (IRS: About Form 8832)

Form 8832 is important for managing tax liability and compliance. Without filing, an eligible entity is taxed according to default IRS rules, which may not align with the owners’ financial or strategic goals.

LLCs and certain other business entities can file Form 8832 to elect or change their tax classification. You generally need to file if:

Your LLC wants to be taxed as a corporation instead of the default pass-through taxation

You want a multi-member LLC to be taxed as a partnership

You are converting from a corporation to a different classification

You are creating a single-member LLC and want it treated as a corporation rather than a disregarded entity

Some entities are ineligible for election, such as certain financial institutions, insurance companies, and publicly traded corporations. Always check the IRS instructions for Form 8832 to confirm eligibility.

Currently, Form 8832 cannot be filed directly online through the IRS website. Businesses must submit the completed form by mail or through an authorized third-party service provider. Approved systems ensure:

Accurate completion of required fields

Proper signature by the authorized representative

Inclusion of necessary declarations and certifications

Proof of submission for recordkeeping purposes

While Docusign can be used to collect and manage signed authorization documents, the IRS requires physical or authorized third-party submission for the actual Form 8832 filing.

Disclaimer: These templates are provided for informational purposes only and do not constitute legal advice. They should not be construed as regulatory, legal, or privacy law compliant. The templates are not a substitute for professional legal counsel and should not be relied upon for any specific situation or circumstance. Users are strongly advised to consult with a qualified attorney licensed in their jurisdiction before using or adapting these templates.

The templates are provided on an "as is," "with all faults," and "as available" basis. The provider expressly disclaims all warranties of any kind, whether express, implied, statutory, or otherwise, including but not limited to any warranties of merchantability, fitness for a particular purpose, or non-infringement.

Docusign does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials in these templates or otherwise relating to such materials or on any sites linked to these templates.

Stay on top of payroll taxes. File your employer's quarterly federal tax returns with our fillable 941 form.

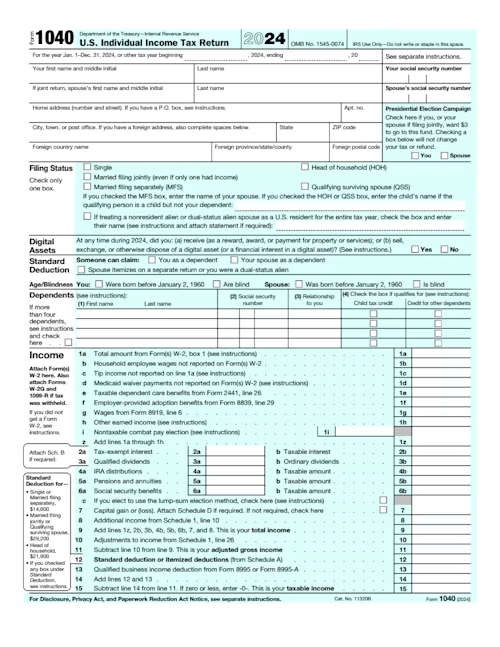

Tax season is here! Easily populate 1099s for your independent contractors. Don't wait until the deadline. Use our 1099 template.

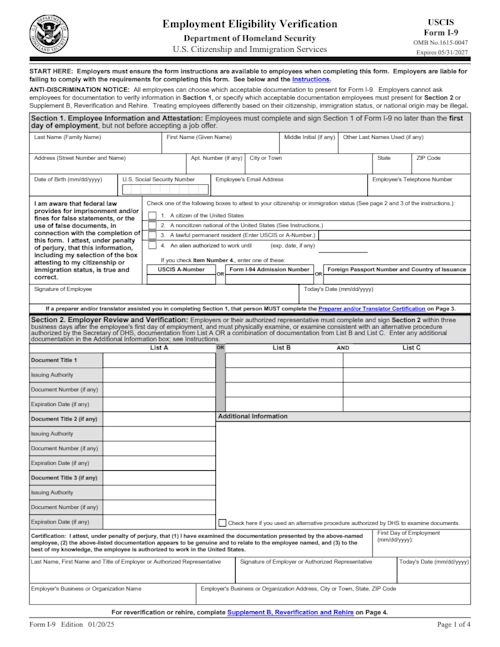

Before you pay a contractor, get a W-9. Our customizable W-9 form makes it easy to collect all the necessary information the IRS is looking for.

Stay on top of payroll taxes. File your employer's quarterly federal tax returns with our fillable 941 form.

Tax season is here! Easily populate 1099s for your independent contractors. Don't wait until the deadline. Use our 1099 template.

Before you pay a contractor, get a W-9. Our customizable W-9 form makes it easy to collect all the necessary information the IRS is looking for.