Promissory Note template

Ensure you get paid back. Our promissory note template is an enforceable IOU that details the amount, interest, and repayment schedule.

You will need to switch to a laptop, tablet, or desktop to use this template.

- Updated Jan 21, 2026

- Created by Docusign

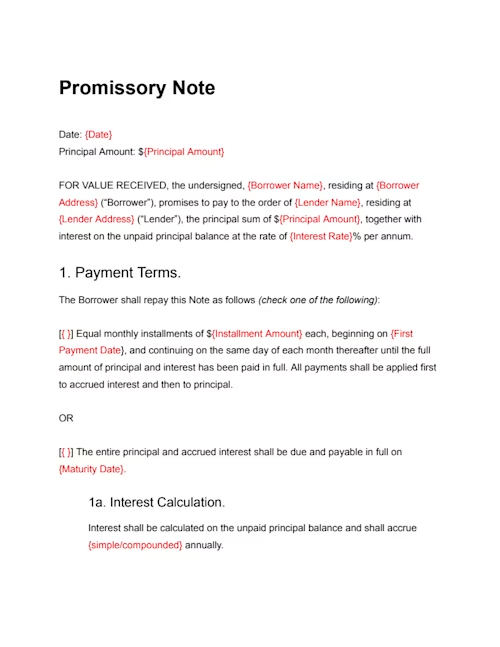

Free promissory note template

A promissory note is a legal document in which one party promises to repay a debt to another party under specific terms. Better known as a loan agreement, when done correctly the document includes the amount borrowed, the interest rate, the repayment schedule, and the consequences of failing to repay. The agreement is essential for personal loans, business loans, or any financial arrangement where one party is borrowing money.

With Docusign, you can create a free, editable promissory note using our online template. Easily customize the loan agreement to include the loan amount, repayment schedule, add clauses and any other important details. Get started with Docusign today to make the process quick and secure.

To ensure your loan is clearly defined and legally protected, creating a promissory note that covers all the bases is the final step. Our editable promissory template makes it simple to include all the terms, and sending it via Docusign provides a secure, legally enforceable e-signature to execute the contract. All this provides both lender and borrower with an accessible, official record of their loan agreement.

What is a promissory note?

A promissory note is a written agreement between a borrower and a lender saying that the borrower will pay back the amount borrowed plus interest. The promissory note is issued by the lender and is signed by the borrower (but not the lender). It is considered a contract, and signing it legally obligates the borrower to pay back the amount borrowed, plus any interest, as defined in the promissory note.

When do you need to use a promissory note?

A promissory note is essential in any transaction where money is being lent by a person, bank, company, or other organization to another entity. This document is a contract that protects the lender from the risk of the borrower not paying the full amount agreed to by both parties.

Are promissory notes required for family loans?

A promissory note is like an IOU. However, with an informal IOU between friends or family, there is limited—or no—legal recourse if the borrower does not repay the amount borrowed. For small amounts of money that the lender will not miss, a promissory note is probably not necessary.

However, for any transaction where the lender expects the full amount to be repaid, a promissory note may be a good idea. This may seem like an overly formal way to lend money to loved ones, but in circumstances where repayment is not optional, it provides all parties with a legal framework for how to resolve any unpaid debt.

How promissory notes are used in business

Promissory notes are commonly used in multiple business contexts. For example:

Land, building or construction purchases

Car or truck purchases

Equipment purchases

Working capital

Employee loans

Loans between businesses

Types of promissory notes

There are several types of promissory notes. The features that differ between types of notes include how and whether the promissory note is secured, detail of repayment requirements, and terms of repayment.

Simple promissory note

As the name suggests, this is a promissory note with only the basics included: the amount owed, the terms, and payment schedule. Simple promissory notes are more common for smaller loans with a single borrower.

Secured promissory note

A secured promissory note is an agreement where the borrower puts something of value up as collateral to safeguard the value of the loan. In the event the borrower is unable to make payments and defaults on the loan, a secured promissory note empowers the lender to take possession of the collateral in lieu of payment.

Unsecured promissory note

An unsecured promissory note does not require the borrower to provide any collateral in order to receive the loan. However, an unsecured promissory note is still a contract, and as such the lender has legal options to collect any overdue payments.

Unsecured promissory notes are common in real estate transactions, because the mechanism for securing the loan is the mortgage, rather than separate collateral associated with the promissory note. While they are very similar, the unsecured promissory note only represents the borrower’s promise to pay the full amount plus interest, while a mortgage puts a lien on the real estate that allows the lender to foreclose on it in the case of nonpayment.

Master promissory note

A master promissory note is an ongoing agreement between the borrower and the lender. Similar to a master services agreement, a master promissory note allows both parties to agree to a set of terms that will govern multiple loan agreements. This type of promissory note is commonly used for student loans, where multiple loans are expected to be taken out over a relatively short period of time.

Open-ended promissory note

An open-ended promissory note is similar to a line of credit. Rather than receiving the full amount of funds immediately, the borrower only receives a portion and pays that back over the period of time agreed to in the promissory note. This allows the borrower to draw additional funds later that are governed by the same promissory note without having to take more than they initially need.

Demand promissory note

A demand promissory note foregoes details about multiple payments in favor of a single payment being due upon demand of the lender. These types of promissory notes generally have requirements for advance notice of intent to collect.

Balloon promissory note

A balloon promissory note has all the usual repayment requirement details, with one important distinction. Instead of an even amount of payments over the term of the loan, smaller payments are made at first and a single large payment is made at the end. These can be appealing for small business borrowers because it allows them more runway for building revenue before needing to pay off the loan.

What is included in a promissory note?

A promissory note must contain the following essential components:

Date: The date the note is created.

Principal amount: The amount of money being borrowed.

Parties’ names and addresses: Full legal names and addresses of both the Borrower and the Lender.

Promise to pay: Clear language indicating the Borrower’s obligation to pay the Lender.

Repayment terms: How and when payments will be made (installments or lump sum), including start dates and maturity date if applicable.

Interest rate: The rate of interest charged on the unpaid balance, if any.

Signatures: Signatures of both the Borrower and the Lender, and the date of signing.

Governing law: The state or jurisdiction whose laws will apply.

Additional (optional) components

Including additional clauses can help clarify the agreement and provide further protection for both parties. Optional clauses may include:

Late fees: Specifies any penalties for late payments.

Default & acceleration clause: Outlines what happens if the Borrower defaults, including the Lender’s right to demand full repayment.

Prepayment: States whether the Borrower can pay off the loan early without penalty.

Assignment: Determines whether the Borrower or Lender can transfer their rights or obligations to another party.

Waiver of presentments: Borrower waives certain formalities, such as demand for payment or notice of dishonor.

Amendments: Requires changes to the note to be in writing and signed by both parties.

Severability: Ensures that if any part of the note is invalid, the rest remains in effect.

Notices: Specifies how official communications between parties must be delivered.

Disclaimer: These templates are provided for informational purposes only and do not constitute legal advice. They should not be construed as regulatory, legal, or privacy law compliant. The templates are not a substitute for professional legal counsel and should not be relied upon for any specific situation or circumstance. Users are strongly advised to consult with a qualified attorney licensed in their jurisdiction before using or adapting these templates.

The templates are provided on an "as is," "with all faults," and "as available" basis. The provider expressly disclaims all warranties of any kind, whether express, implied, statutory, or otherwise, including but not limited to any warranties of merchantability, fitness for a particular purpose, or non-infringement.

Docusign does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials in these templates or otherwise relating to such materials or on any sites linked to these templates.

Create a free account to start using this Docusign template now