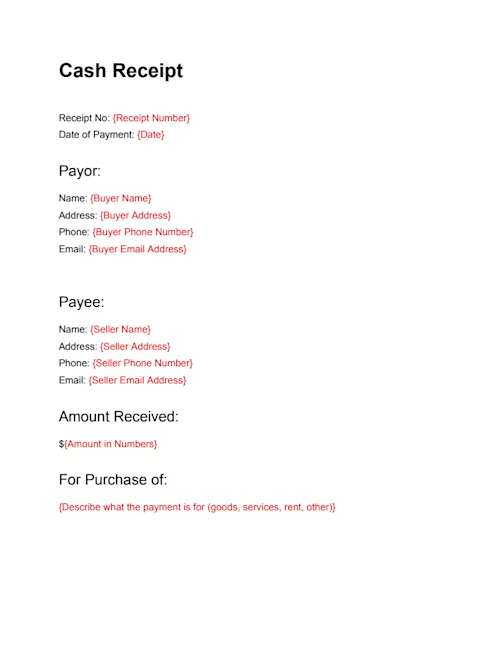

Cash Receipt template

Document a cash transaction instantly. Our simple cash receipt template provides proof of payment for buyers and sellers.

You will need to switch to a laptop, tablet, or desktop to use this template.

- Updated Jan 21, 2026

- Created by Docusign

Free cash receipt template

A cash receipt primarily serves as proof of a transaction that was paid for by cash. You know, good old fashioned paper bills (and coins). Also sometimes referred to as a sales receipt, the simple proof of payment typically includes details like the amount paid, the date of the transaction, the payer’s information, a description of the goods or services provided, and a line item or indication that the item or service was paid for in cash. With our free cash receipt template, you can fill out all the details of the transaction online. The receipt is easy to edit and can be customized to suit the needs of both parties. Once you've filled out the receipt, you can download, print, or send it through Docusign for secure delivery and signature. To use Docusign’s sample cash receipt, click on the template below:

To protect your business and your customers, ensure every cash transaction needs clear documentation. Docusign’s cash receipt template should serve this purpose, and using our editable template makes creating one simple. Sending it electronically with Docusign provides both parties with a secure, accessible copy for their records, which is invaluable for tracking payments and resolving disputes.

What is a cash receipt?

A cash receipt is a written acknowledgment that payment has been received from a customer or client. It typically includes details such as the date, amount paid, payment method, and purpose of the payment. Businesses use cash receipts to maintain accurate financial records and provide proof of transactions to customers.

When do you need a cash receipt?

You should issue a cash receipt whenever money changes hands in a business transaction, including:

Sales of goods or services

Rent or lease payments

Loan repayments

Donations or contributions

Refunds or deposits returned

Providing a receipt not only documents the transaction but also builds trust with customers and helps meet legal or tax compliance requirements (IRS Small Business & Self-Employed Guide).

What information should be on a cash receipt?

A cash receipt should include the following:

Receipt title: Clearly labeled as "Cash Receipt."

Receipt number: A unique identifier for tracking.

Date of transaction: The date when payment was received.

Amount received: The total cash amount paid.

Payer’s information: Name and, if applicable, contact details of the person or entity making the payment.

Payee’s information: Name and contact details of the recipient (business or individual).

Description of goods/services: Brief description of what the payment is for.

Payment method: Specify “cash” to clarify the mode of payment.

Signature: Signature of the person issuing the receipt.

Additional (optional) elements

Balance due or paid in full statement: Indicates if the transaction settles all dues.

Tax details: Breakdown of any applicable taxes (e.g., VAT, sales tax).

Company logo or branding: For business receipts.

Terms and conditions: Any relevant policies or disclaimers.

Contact information: Phone, email, or address for further inquiries.

Reference/invoice number: If related to a specific invoice.

Disclaimer: These templates are provided for informational purposes only and do not constitute legal advice. They should not be construed as regulatory, legal, or privacy law compliant. The templates are not a substitute for professional legal counsel and should not be relied upon for any specific situation or circumstance. Users are strongly advised to consult with a qualified attorney licensed in their jurisdiction before using or adapting these templates.

The templates are provided on an "as is," "with all faults," and "as available" basis. The provider expressly disclaims all warranties of any kind, whether express, implied, statutory, or otherwise, including but not limited to any warranties of merchantability, fitness for a particular purpose, or non-infringement.

Docusign does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials in these templates or otherwise relating to such materials or on any sites linked to these templates.

Cash Receipt FAQs

No. Despite the name, “cash receipt” can also document payments made via check, money order, or electronic transfer.

Businesses should retain receipts for at least three to seven years depending on tax and compliance requirements.

Create a free account to start using this Docusign template now